what items are exempt from sales tax in tennessee

Clothing with a price of 100 or less per item. Ad Your Business Partner for All Things Sales Tax.

States Without Sales Tax Article

All individuals as well as businesses operating in the state must pay use tax when the sales tax was not collected by the seller on otherwise.

. Tennessee has a statewide sales tax rate of 7 which has been in place since 1947. Sales of medical services are exempt. Sales of raw materials are exempt from the sales tax in Tennessee.

Our Team Includes CPAs Lawyers Former Auditors Other Sales Tax Professionals. Information for farmers timber harvesters nursery operators and dealers from whom they buy to understand the scope of exemptions and reduced rates the purchases. Since the state of Tennessee started collecting a sales tax in 1947 certain items have been considered tax-exempt because these items go into producing items which will be taxed by the.

Textbooks and workbooks are exempt from sales tax. SALES AND USE TAX. SUT-21 - Sales and Use Tax for Contractors - Overview.

12 -Tennessee Sales Tax Exemptions. Apply for and receive the Sales and Use Tax Certificate of Exemption from the Department of Revenue before making tax-exempt purchases. The use tax is the counterpart to the sales tax.

43 rows Several examples of of items that exempt from Tennessee sales tax are medical supplies. Online Filing - All sales tax returns must be filed and paid electronically. During the holiday the following items are exempt from sales and use tax.

The application is available on the. Exempt Items Tennessee Code Annotated Section 67-6-393 Note. Groceries is subject to special sales tax rates under Tennessee law.

Some exemptions are based on the product purchased. Sales Tax Holiday Alphabetical Directory. To learn more see a full list of taxable and tax-exempt items in Tennessee.

SUT-33 - Sale for Resale - Out-of-State Resale Certificates. Cell Phones including smart phones Clothing Accessories or Equipment. A textbook is defined.

Sales and Use Tax Forms. Sales of machinery are exempt from the sales tax in Tennessee. Please visit the Filing and State Tax section of our website for more information.

Our Team Includes CPAs Lawyers Former Auditors Other Sales Tax Professionals. Mining Photography Printing Digital Products Contractors Water Pollution Control Prescription Eyewear. 18 rows Several examples of items that are considered to be exempt from Tennessee sales tax are.

STH-11 - Textbooks are Exempt from Sales and Use Tax. Transparent Flexible Fixed-Fee Pricing. No items used in trade or business are exempt under these provisions.

This article has been updated to reflect the repeal of Sales and Use Tax Rule 96 and is effective January 10 2022. Ad Your Business Partner for All Things Sales Tax. SALES AND USE TAX 2 Dear Tennessee Taxpayer This sales and use tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of Tennessee sales.

Generally contractors and subcontractors are users and consumers and must pay tax on the purchase price of materials. Therefore no holiday is necessary. Tennessee does not exempt any types of purchase from the state sales tax.

Incidental items worn on the person or in. Sales of medical devices are exempt from the sales tax in Tennessee. Breathing Masks Bridal apparel other than gowns or veils Briefcases.

Several examples of of items that exempt from Tennessee sales tax are medical supplies certain groceries and food items and items used in packaging. Municipal governments in Tennessee are also allowed to collect a local-option sales tax that ranges from. For example gasoline textbooks school meals and a number of healthcare products are not subject to the.

Transparent Flexible Fixed-Fee Pricing. STH-2 - Sales Tax Holiday - Qualifying Items. The Tennessee sales tax exemption for manufacturing also.

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

What Canadian Businesses Need To Know About U S Sales Tax Madan Ca

Check Out All The Latest 6pm Com Coupon Codes Promo Codes Discounts For How To Apply Coupons North Face Kids

Sales Tax On Grocery Items Taxjar

The Confusing State Of States Sales Tax Trust Transparency Center

Tennessee Sales Tax Small Business Guide Truic

Global Shoppers You Don T Have To Pay Us Sales Tax

Tennessee Holding Three Sales Tax Holidays For 2021 Here S What You Need To Know Wjhl Tri Cities News Weather

Tennessee S Tax Free Weekend 2021

Beginner S Guide To Dropshipping Sales Tax Blog Printful

Home Depot Sales Tax On Tool Rental Home Depot Sales Home Tools Rental

Sales And Use Tax Sales Tax Information Tax Notes

List Of Tax Exempt Items Baby Receiving Blankets Emergency Kit Receiving Blankets

States Are Imposing A Netflix And Spotify Tax To Raise Money

States Without Sales Tax Article

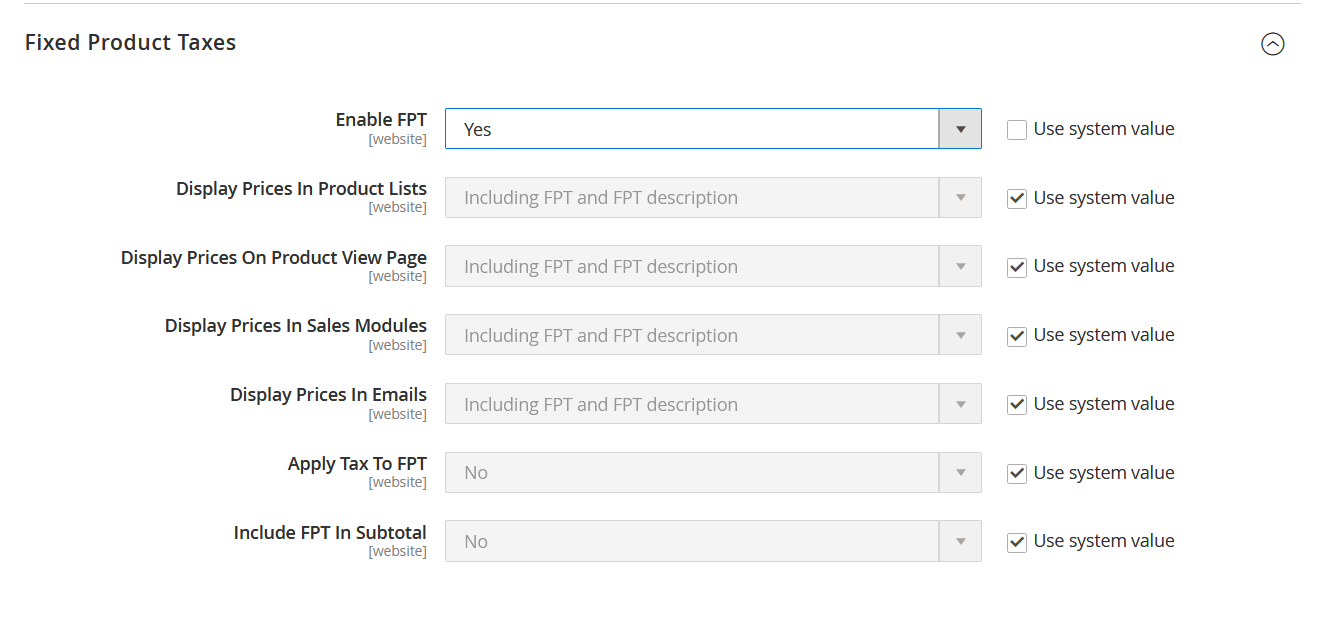

General Tax Settings Adobe Commerce 2 4 User Guide